Identifying the Trees & Appraising the Forest: Avoiding over-engineered reports and identifying the material risks

Appraisal reports don’t exist just to deliver a number—they exist to deliver judgment. The skill is knowing what to include, what to qualify, and how to communicate uncertainty without drowning readers in details. Or as the original piece put it, there’s more to an appraisal than the value conclusion.

Why appraisals get overbuilt (and how to stop it)

“You can’t be all things to all people.”

Overstuffed reports try anyway—usually because stakeholders (counsel, tax advisors, estate planners) ask for “everything,” even when the added volume doesn’t change the valuation or the risk picture. The antidote is scoping with intent: design the assignment around the value question, the relevant property rights, and the decision your intended users must make. (Argianas)

Principle: disclose what’s material, qualify what’s uncertain, and resist padding that obscures your conclusions.

A real-world tangle (and the lesson inside)

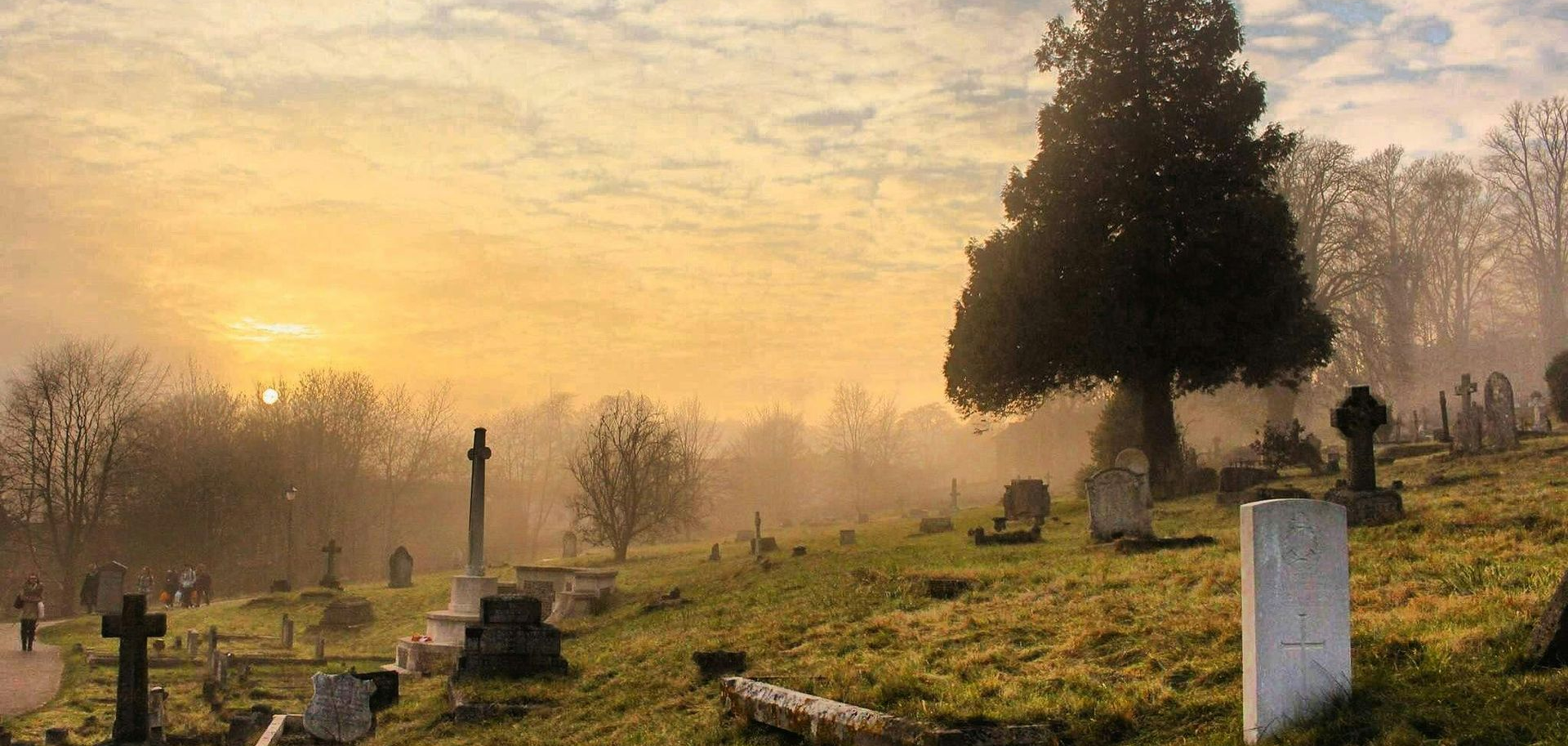

The scenario. After a decades-long lease on a cemetery property expired, the landowner and the operating business spent years in a legal dispute over rent. During the stalemate, the operator began renovations, demolishing some improvements; the site sat mid-reconstruction. Both sides wanted different things—continued renovations vs. rent certainty—and “fair market rent” hinged on which real property rights existed and how they interacted with the partially completed improvements.

The lesson. Before you can value, you must vet the entitlements and lease rights associated with the land, structures, and improvements. When facts are in dispute or documents are incomplete, proceed—but declare the uncertainty and its valuation consequences to your intended users.

The tools that keep you honest

1) Extraordinary assumptions (and how to use them well)

When you must analyze despite missing or disputed facts, you can proceed subject to extraordinary assumptions—explicit statements about uncertainties that the value opinion relies on. They are not shortcuts; they are disclosures that frame risk for users and for the court record. Cemetery matters frequently require this approach due to the mix of license, privilege, and interment rights that blur classic leasehold logic.

Good practice:

- State the assumption in plain language.

- Tie it to the affected inputs (e.g., rent commencement, repair obligations, interment rights, access/easements).

- Quantify the sensitivity where feasible (e.g., “If X right is not confirmed, indicated value declines by ~Y%”).

2) Intended users & scope discipline

Identify who will rely on the report and why (litigation support, negotiations, lending, tax appeal). Then right-size data collection, modeling depth, and reporting format to that audience—while preserving independence and objectivity.

3) Legal context, not legal conclusions

Interpretive disputes happen—especially with old leases. Track them as appraisal risks (inputs you cannot independently resolve). Note related doctrines (e.g., laches, where inaction over time may limit recourse) to explain why certain claims may or may not affect value—but stop short of rendering legal opinions.

A repeatable workflow for complex, contested assignments

- Triage & framing

- Define the value question (e.g., market rent vs. fee simple value vs. leased fee).

- Identify property rights at issue: fee title, leasehold, licenses, interment rights, easements, development rights.

- Document map

- Leases, amendments, side letters, estoppels, purchase options, trust/operating agreements, permits, entitlements, construction contracts/change orders.

- Create a “fact status” legend: confirmed / disputed / missing—and link each to a proposed extraordinary assumption if needed.

- Physical & functional check

- Current condition (including partially demolished or mid-renovation components), code compliance, site access, utilities, phasing.

- For cemeteries: status of interment inventory, sections under construction, and any operational disruptions caused by works in progress.

- Rights & obligations analysis

- Who pays for what (shell, site work, specialized improvements)?

- Repair/restore duties after demolition or casualty; timing and remedies on default/holdover.

- For cemetery properties, detail interment rights structure (license vs. lease vs. privilege) and the financial implications for rent and expenses.

- Income and cost modeling under alternative legal states

- Build scenarios matching each plausible legal interpretation (e.g., rent resets allowed vs. not; obligation to restore improvements vs. not).

- Assign probabilities only if supported; otherwise present range-bound indicators with narrative preference and rationale

- Disclosure package

- Prominent extraordinary assumptions and limiting conditions.

- A single-page risk memo for intended users summarizing how unresolved issues could swing the value or rent opinion.

What to include (and what to leave out)

Must-haves:

- The specific rights appraised and any rights excluded.

- The status of disputed facts, mapped to explicit assumptions.

- How uncertainties flow through the model (show your levers and ranges).

- Clear, decision-ready conclusions: base case, edges of the range, and what would move you from one to the other.

Nice-to-have (only if decision-relevant):

- Extensive market comp appendices, engineering minutiae, or legal treatises that don’t change your indicator values or risk assessment.

Common pitfalls (and how to avoid them)

- Ambiguity amnesia: treating old, vague lease clauses as settled law. Flag them and model alternatives.

- Construction blind spots: valuing mid-renovation properties as if improvements were stable or fully contributory. Adjust for condition and completion risk.

- Rights mismatch: applying standard lease economics to license/privilege structures (common in cemeteries) without re-tooling the cash flows.

- Disclosure drift: burying extraordinary assumptions in the back matter. Put them up front, tie them to numbers, and write them plainly.

Mini-checklist: before you sign

- Have we defined the rights appraised and tied them to the legal documents in the file?

- Are all disputed/missing facts surfaced, and are extraordinary assumptions worded so that a non-appraiser can understand them?

- Does the model show how each uncertainty affects value/rent?

- Is our conclusion decision-oriented for the intended users, not just document-heavy?

Closing thought

On complex matters, the scope you thought you had on day one will evolve. That’s normal. Your job is to keep independence, surface the legal and factual forks that matter, and qualify your conclusions so users can act—with eyes open.

Feeling six feet under with a dusty lease or a half-finished property fight? The Argianas team can help you parse the rights, frame the risks, and produce a defensible, decision-ready opinion. Call 630.390.0113.