The Smart Leverage!

The Mechanics of Unleveraged, Positively Leveraged, & Negatively Leveraged Commercial Real Estate Financing

Get-rich-quick schemes have been around as long as snake-oil salesmen and are about as effective. But with a bit of know-how and planning, there are favorable financing opportunities that investors should explore. “One thing I find fascinating about commercial real estate investment is that I can buy a $1 million property on credit, but I can’t walk into my brokerage firm and buy $1 million in stock,” shares Vice President Alexander Argianas. “It presents a wonderful opportunity for an investor, and conceptually, it isn’t very abstract – ordinary people spend money, the smart leverage,” he adds.

Buying and selling real estate can be a complex and emotional experience. Taking a chance on spending a large sum of money is a big decision. Still, there are straightforward quantitative approaches to analyzing a particular deal that yield a clear rationale for employing debt financing for a purchase. For the team at Argianas & Associates, Inc., this means analyzing the numbers. At best, debt financing significantly reduces the capital required by the investor and boosts the investor’s return on equity.

Commercial Real Estate Debt & The Incomes They Yield

Commercial real estate (e.g., strip retail center, office building complex, rented industrial properties, ground leases, etc.) often generates rental income. This income or potential gross income (PGI) is a real property right that the property owners are entitled to. Therefore, the purchase of an income-producing property is often an attractive option for investors as the property serves as an asset and the income a consistent and stable revenue stream.

Unleveraged & Leveraged Debt

New terms, equations, large sums of money – it’s easy to get overwhelmed; however, the financial equations and relationships to determine if financing is right are simple. For all scenarios, let’s assume your company, NewCo. has $1 million to invest and is interested in exploring the use of financing for the purchase. A property with a sale price of $1 million has been identified and has a net operating income (NOI) of $100,000. An NOI is the income after subtracting operating expenses and vacancy and collection loss from PGI.

As an advisor and high-powered decision-maker at NewCo., you have two options: NewCo. can purchase the property outright with an all-cash offer to the seller, or as a savvy investor, you can suggest the company finance the purchase of the property with an 80% loan to value ratio. NewCo. purchases the property with 20% equity of its market value ($200,000 upfront at purchase) and finances the remaining $800,000 of the purchase price through a local community bank or credit union.

Unleveraged to Positive Leverage: Measuring Up The Details

With a low cost of borrowing, a stable earnings history, and a reasonable loan to value ratio, the benefits of borrowing money to finance a deal often outweigh purchasing a property as an all-cash acquisition (not to mention investment diversification & risk management). The advantage in borrowing money comes from an overall increase in yield or return on cash invested (also known as the equity dividend rate or cash on cash rate). But does it always make sense?

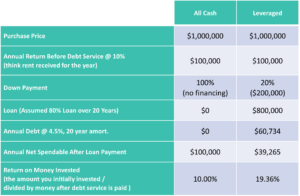

In our example from above, let’s assume that your commercial lender will offer you financing for your commercial loan at 4.5% compounded monthly for 20 years. The table below compares an all-cash scenario to a leveraged scenario.

If we were to purchase the property outright, our return on money invested would be 10%; however, when we borrow and finance the purchase of the property, our cash-on-cash return is much higher. Why? In this example, borrowing money resulted in a net increase, and we positively leveraged our capital. In other words, the use of debt to acquire a property increases the overall return on an investor’s equity capital or the initial amount of money for the purchase. In contrast, the unleveraged return (our $1 million divided by our yearly rent of $100,000) is an all-cash internal rate of return (IRR) that a real estate investment achieves without financing.

When It Doesn’t Pencil Out

Are you scratching your head yet? If you’re following you can see NewCo. did boost its yield by borrowing money and financing the purchase of the property. Simply put, the income the property produces is sufficient to yield a higher return. But is this the secret to riches? Well, like all good things in finance, it depends.

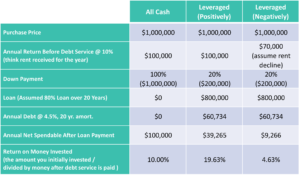

With all investing there are risks and savvy investors do their best to identify and mitigate those risks. In an analysis based on the property’s income-generating capacity, what would happen if the annual revenue was not stable, a lease for a large tenant ended, or the tenant can no longer pay? The NOI of the property would decline. Assuming the NOI was to drop to $70,000 NewCo. would be better off purchasing the property outright. Let’s take another look with updated financials.

With the same terms but a decrease to NOI, we see that the return or yield on money has dropped substantially. In this instance, debt detracts from the return resulting in negative leverage.

K.I.S.S. or Keep it simple … silly

In the examples outlined above, we found that financing the property purchase could increase our yield almost two-fold compared to simply purchasing the property outright. Conversely, modifications to the property’s NOI resulted in a negatively leveraged scenario. So quantitatively, the answer for NewCo. was simple, employ financing and magnify your yield while ensuring your cash flows remain stable!

“It is fair to say that strategy is involved when buying a property,” said Alexander. “But that strategy needs to be quantified, simple back-of-the-napkin calculations can help you and your team quickly identify opportunities and boost unleveraged returns to a significantly greater return on equity,” he added. Coupled with the properties’ potential future net operating income and future market value, a calculated decision can mean significant capital returns.

Economic Voodoo?

Analyzing the financing option most beneficial for commercial real estate purchases is simple and will leave you in good company. The National Council of Real Estate Investment Fiduciaries Property Index (NCEIF-NPI) measures returns for institutional investors. During the first quarter of 2021, the NCREIF-NPI increased, reaching pre-COVID levels. Indeed, it is often true that leveraged returns continue to be higher than unleveraged returns in the market (small business and investment-grade real estate assets).

Wondering how you can get in on the action? Wanting to look good for YOUR NewCo.? Then, call the expert team at Argianas at 630.390.0113 to walk you through your potential deal and see how we can help. You’ll be glad you did!